U.S. stock futures higher in pre-market trading for Tuesday, April 24. The Nasdaq Futures is trading at 6,670.75 up with +0.06% percent or +3.75 point.The S&P 500 Futures is trading at 2,674.75 up with +0.13% percent or +3.50 point.The Dow Futures is trading at 24,445.00 up with +0.13% percent or +31.00 point.

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,278.12 up with +0.86% percent or +190.08 point. Hong Kong’s Hang Seng is trading at 30,511.07 up with +0.85% percent or +256.67 point. China’s Shanghai Composite is trading at 3,120.67 up with +1.72% percent or +52.66 point. India’s BSE Sensex is trading at 34,575.40 up with +0.36% percent or +124.63 point at 12:15 PM.The FTSE 100 is trading at 7,429.72 up with +0.42% percent or +30.85 point. Germany’s DAX is trading at 12,579.61 up with +0.057% percent or +7.22 point. France’s CAC 40 is trading at 5,429.10 with a loss of -0.17% percent or -9.44 point. The Stoxx Europe 600 is trading at 383.26 up with +0.03% percent or +0.17 point.

Tuesday’s Factors and Events

Monday’s Activity

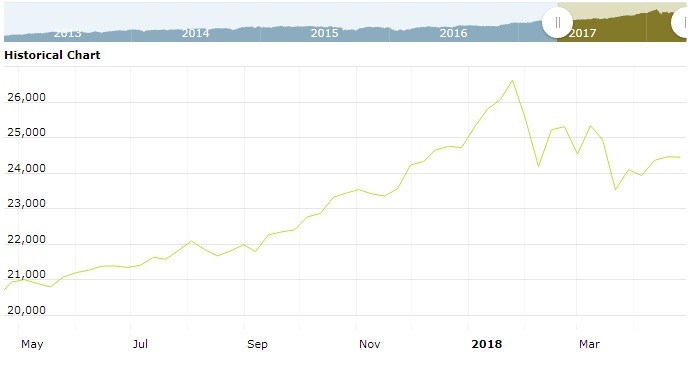

U.S. market were lower on Monday.For the day the Dow is trading at 24,448.69 with a loss of -0.058% percent or -14.25 point. The S&P 500 is trading at 2,670.29 up with +0.0056% percent or +0.15 point. The Nasdaq Composite is trading at 7,128.60 with a loss of -0.25% percent or –17.52 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,562.12 with a loss of -0.13% percent or -2.00 point; the S&P 600 Small-Cap Index closed at 961.77 up with +0.0010% percent or +0.010 point; the S&P 400 Mid-Cap Index closed at 1,900.96 up with +0.024% percent or +0.46 point; the S&P 100 Index closed at 1,170.43 with a loss of -0.0017% percent or -0.020 point; the Russell 3000 Index closed at 1,584.05 with a loss of -0.021% percent or –0.33 point; the Russell 1000 Index closed at 1,481.00 with a loss of -0.012% percent or -0.18 point;

The financial services industry is constantly developing new products to serve the ever-changing wants and needs of a diverse array of investors. While Wall Street financial innovation can lead to problems (e.g., the exotic mortgage debt instruments that helped fuel the 2008 financial crisis), investment banks occasionally launch new products worthy of investors’ attention. I think green bonds are an interesting product that is worth considering for many investors.

Green bonds, like traditional bonds, are fixed income instruments that are used by governments, companies, and NGOs to raise capital through the debt markets. Their structure is not fundamentally different from the corporate bonds, government bonds, and municipal bonds with which many investors are familiar.

However, green bonds differ from traditional bonds in that the issuers of green bonds publicly state that the capital raised through the issue will fund projects, assets, or business activities with an environmental benefit. These activities might include renewable energy, sustainable forestry, or energy-efficiency projects, to name a few examples. Also, capital might be used to fund projects with social or community benefits, such as improving social services or increasing accessibility to healthcare.