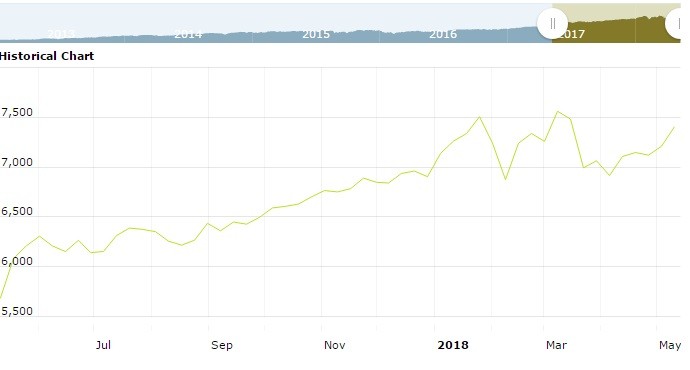

U.S. stock futures higher in pre-market trading for Friday, May 11.The Nasdaq Futures is trading at 6,956.25 with a loss of -0.13% percent or -8.75 point.The S&P 500 Futures is trading at 2,718.00 with a loss of -0.03% percent or -0.75 point.The Dow Futures is trading at 24,698.00 up with +0.02% percent or +6.00 point.

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,758.48 up with +1.16% percent or +261.30 point. Hong Kong’s Hang Seng is trading at 31,119.25 up with +1.00% percent or +309.36 point. China’s Shanghai Composite is trading at 3,163.26 with a loss of -0.35% percent or -11.15 point. India’s BSE Sensex is trading at 35,355.42 up with +0.31% percent or +109.15 point at 12:15 PM.The FTSE 100 is trading at 7,698.89 with a loss of -0.027% percent or -2.08 point. Germany’s DAX is trading at 13,005.59 with a loss of -0.14% percent or -17.79 point. France’s CAC 40 is trading at 5,528.13 with a loss of -0.32% percent or -17.82 point. The Stoxx Europe 600 is trading at 391.94 with 0.00% percent or –0.01 point.

Friday’s Factors and Events

Thursday’s Activity

U.S. market were higher on Thursday.For the day The Nasdaq Composite is trading at 7,404.97 up with +0.89% percent or +65.07 point. the Dow is trading at 24,739.53 up with +0.80% percent or +196.99 point. The S&P 500 is trading at 2,723.07 up with +0.94% percent or +25.28 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,603.71 up with +0.48% percent or +7.66 point; the S&P 600 Small-Cap Index closed at 985.78 up with +0.58% percent or +5.65 point; the S&P 400 Mid-Cap Index closed at 1,937.91 up with +0.73% percent or +14.02 point; the S&P 100 Index closed at 1,197.16 up with +0.97% percent or +11.47 point; the Russell 3000 Index closed at 1,616.38 up with +0.86% percent or +13.80 point; the Russell 1000 Index closed at 1,510.45 up with +0.89% percent or +13.37 point;

The United States imposed sanctions on Friday against six individuals and three companies it said were funneling millions of dollars to Iran’s Islamic Revolutionary Guard’s elite Quds Force, just days after President Donald Trump withdrew from the 2015 Iran nuclear deal.

The Treasury Department, acting with the United Arab Emirates where front companies were located, said it had disrupted the large network’s operations, and accused Iran’s central bank of helping the group access U.S. dollars held in foreign banks to sidestep Western sanctions.

The IRGC is by far Iran’s most powerful security entity and has control over large stakes in Iran’s economy and huge influence in its political system. The Quds Force is an elite unit in charge of the IRGC’s overseas operations.

The six individuals and three entities, including front companies for the IRGC-QF and currency traders, were sanctioned under U.S. regulations targeting specially designated global terrorist suspects and Iranian financial activity, the Treasury said.