U.S. stock futures lower in pre-market trading for , September 02 The Nasdaq Futures is trading at 7,680.75 with a loss of -0.13% percent or -10.00 point.The Dow Futures is trading at 26,321.00 with a loss of -0.32% percent or -85.00 point.The S&P 500 Futures is trading at 2,922.25 with a loss of -0.09% percent or -2.50 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 20,620.19 with a loss of –0.41% percent or –84.18 point. Hong Kong’s Hang Seng is trading at 25,591.89 with a loss of –0.52% percent or –132.84point. China’s Shanghai Composite is trading at 2,924.11 up with +1.31% percent or +37.87 point. India’s BSE Sensex is trading at 37,332.79 up with +0.71% percent or +263.86 point at 12:15 PM.The FTSE 100 is trading at 7,308.19 up with +1.40% percent or +101.16 point. Germany’s DAX is trading at 11,988.30 up with 0.41% percent or +49.02 point. France’s CAC 40 is trading at 5,499.60 up with +0.35% percent or +19.12 point. The Stoxx Europe 600 is trading at 382.02 up with +0.67% percent or +2.55 point.

Monday’s Factors and Events

The Cboe Volatility Index (VIX), widely considered to be the best fear gauge on Wall Street, traded as high as 24.81 in August before pulling back to around 18. Investors also loaded up on traditionally safer assets such as gold and silver this month. The SPDR Gold Trust (GLD) rose 8% in August while the iShares Silver Trust (SLV) surged 12.8%.

Last week, China retaliated against U.S. tariffs by unveiling levies of its own that target $75 billion in U.S. products. President Donald Trump then said the U.S. would hike tariffs on a slew of Chinese products.

“For U.S.-China trade to cause a sustainable rally, we need some proof of actual movement towards a trade ‘truce,’” said Tom Essaye, founder of The Sevens Report, in a note. “While rhetoric has improved, that did not happen.”

Tuesday Activity

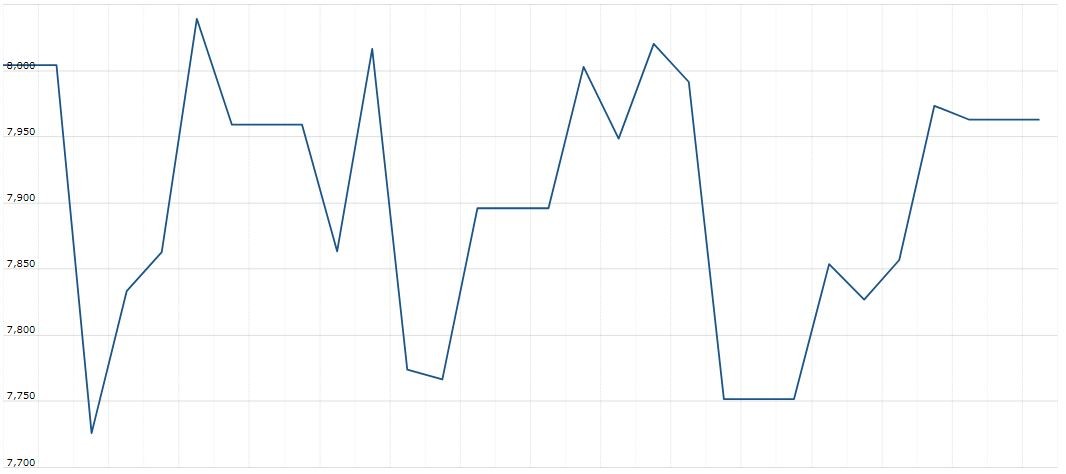

For the day The Nasdaq Composite is trading at 7,962.88 with a loss of –0.13% percent or –10.51 point.the Dow is trading at 26,403.28 up with +1.41% percent or +367.18 point. The S&P 500 is trading at 2,926.46 up with +0.064% percent or +1.88 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,494.84 with a loss of –0.13% percent or -1.88 point; the S&P 600 Small-Cap Index closed at 918.74 with a loss of –0.14% percent or -1.30 point; the S&P 400 Mid-Cap Index closed at 1,881.20 up with +0.21% percent or +3.99 point; the S&P 100 Index closed at 1,292.38 up with +0.047% percent or +0.61 point; the Russell 3000 Index closed at 1,715.24 up with +0.048% percent or +0.82 point; the Russell 1000 Index closed at 1,618.61 up with +0.060% or +0.97 point.