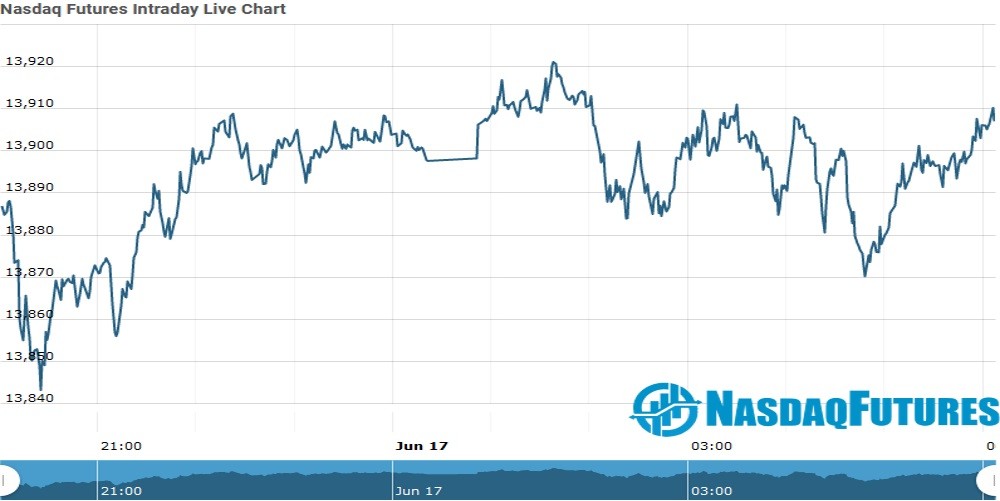

U.S. stock lower in pre-market trading for,June 17.The Nasdaq Futures is trading at 13,892.20 with a loss of -0.54% percent or -75.50 point.The Dow Futures is trading at 33,776.50 with a loss of -0.38% percent or -128.50 point.The S&P 500 Futures is trading at 4,195.38 with a loss of -0.42% percent or -17.62 point.

In other parts of world, Japan’s Nikkei 225 is trading at 29,032.95 with a loss of – percent or –258.06 point. Hong Kong’s Hang Seng is trading at 28,471.18 up with + percent or +34.34 point. China’s Shanghai Composite is trading at 3,523.71 with percent or +5.38 point. India’s BSE Sensex is trading at 52,369.87 with percent or ?132.11 point at 12:15 PM.For the day the FTSE 100 closed at 7,184.95 up with +percent or +12.47 point. France’s CAC 40 closed at 6,652.65 with + percent or +13.13 point.Germany’s DAX closed at 15,710.57 with a loss of – percent or –18.95 point.

Thrsday’s Factors and Events

The disruptions in Shenzhen and Guangzhou are absolutely massive. Alone, they would have an unprecedented supply chain impact,” said Brian Glick, founder and CEO at supply chain integration platform Chain.io, told CNBC.

However, combined with the challenges that the global supply chain has faced since this year, shipping is in “absolutely uncharted waters

wednesday Activity

Other leading market index closes included the small-cap Russell 2000 Index closed at 2,314.69 with a loss of -0.23% percent or -5.38 point; the S&P 600 Small-Cap Index closed at 1,389.57 up with -0.06% percent or -0.88 point; the S&P 400 Mid-Cap Index closed at 2,706.22 with a loss of – percent or ?17.87 point; the S&P 100 Index closed at 1,922.28 with a loss of –percent or ?8.90 point; the Russell 3000 Index closed at 2,527.36 with a loss of –percent or ?12.50 point; the Russell 1000 Index closed at 2,377.09 with a loss of – or –12.21 point.