Several futures instruments are derived from the NASDAQ composite index:

- E-mini NASDAQ composite futures

- E-mini NASDAQ biology futures

- NASDAQ-100 futures

- E-mini NASDAQ-100 futures.

NASDAQ is the largest electronically traded stock exchange in the world. The NASDAQ composite is a composite index of all securities traded on the NASDAQ exchange which has been continuously calculated since 1971.

Futures contracts oblige the parties to buy and sell the derivative at a predetermined price at a predetermined time. Futures contracts are beneficial to investors because of the leverage involved. While 100% of the cost is required to purchase stocks and their indexes (without borrowing on margin), only a fraction of five to fifteen percent the value of a futures contract is required to be deposited to gain control of the futures contract.

Therefore, increases and decreases in the value of the futures contracts are a much greater percentage of the capital required to control futures than stocks either bought outright or on margin. Risk of loss and potential for profit are equally amplified through this leveraging.

NASDAQ derived futures

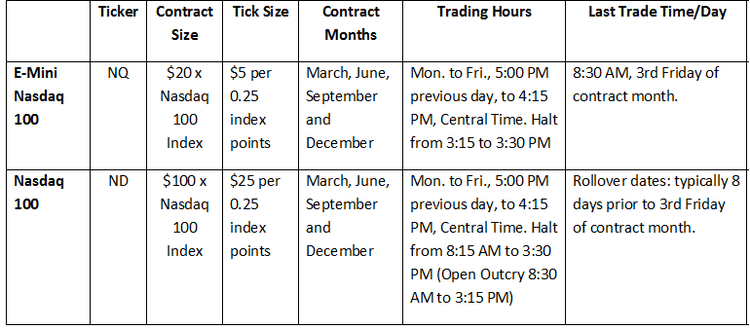

All of the NASDAQ derived future contracts are a product of the Chicago Mercantile Exchange (CME). They expire quarterly (March, June, September, and December), and are traded on the CME Globex exchange nearly 24 hours a day, from Sunday afternoon to Friday afternoon.

E-mini NASDAQ Futures (ticker: QCN) contract’s minimum tick is .50 index points = $10.00. CME requires $4,000, and continuing equity of $3,200 to maintain the position.

E-mini NASAQ Biotechnology Futures (ticker: BIO) contract’s minimum tick is .10 index points = $5.00. CME requires $3,750, and continuing equity of $3000 to maintain the position.

NASDAQ-100 Futures (ticker: ND) contract’s minimum tick is .25 index points = $25.00. CME requires $17,500, and continuing equity of $14,000 to maintain the position.

E-mini NASDAQ-100 Futures (ticker: NQ) contract’s minimum tick is .25 index points = $5.00. the CME requires $3,500, and continuing equity of $2,800 to maintain the position.

Each Nasdaq futures contract has an expiry date, on the third Friday of the contract month. Traders typically close out positions before expiry, and re-establish positions in contracts where the expiry date is further out.

Nearly all volume takes place in the futures contract near expiry. For example, in February, nearly all the trading volume will take place in the March contract. In April, nearly all the volume will occur in the June contract. When the June contract is about to expire, volume will shift to the September contract.

All Nasdaq futures are cleared through the Chicago Mercantile Exchange (CME). E-mini Nasdaq 100 futures change hands via electronic transactions only.

Nasdaq 100 futures change hands through electronic transactions as well as open outcry on the trading floor. Traders who use a broker with access to CME products are able to trade Nasdaq futures electronically.

E-mini Nasdaq 100 futures are very liquid, with approximately 200,000 to 600,000 contracts changing hands each day. This provides adequate liquidity for active day traders, hedge funds and longer-term traders.