U.S. stock futures are higher in pre-market trading for Monday, March 12.The Nasdaq Futures are trading at 7,165.50 for up with +0.58% percent or +41.25 point.The S&P 500 Futures are trading at 2,798.50 for up with +0.35% percent or +9.75 point. The Dow Futures are trading at 25,456.00 for up with +0.38% percent or +96.00 point.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 are trading at 21,824.03 for up with +1.65% percent or +354.83 point. Hong Kong’s Hang Seng are trading at 31,591.32 for up with +1.92% percent or +595.11 point. China’s Shanghai Composite are trading at 3,326.70 for up with +0.59% percent or +19.53 point. India’s BSE Sensex are trading at 33,662.53 for up with +1.07% percent or +355.39 point at 12:15 PM.The FTSE 100 are trading at 7,220.13 with a loss of -0.06% percent or -4.38 point. Germany’s DAX are trading at 12,418.23 for up with +0.58% percent or +71.55 point. France’s CAC 40 are trading at 5,284.21 for up with +0.19% percent or +9.81 point. The Stoxx Europe 600 are trading at 379.28 for up with +0.27% percent or +1.04 point.

Monday’s Factors and Events

Remember during the dot-com bubble of the late 1990s, when pundits liked to talk about the “new economy”? Riding the wave of excitement, the information technology sector grew to well over 30% of the S&P 500, from under 10% less than a decade earlier. The mania ended as companies like Pets.com disappeared while others, such as Cisco and Yahoo!, experienced traumatic share-price declines. It may sound negative to rehash those times, but here’s the thing: The experts weren’t entirely wrong.

While the mania of the late ’90s got out of hand, the basic premise of the new economy has continued to play out. We are indeed transitioning from an industrial, manufacturing-based economy into one characterized more by services and information-based commerce. This evolution has opened new markets and new opportunities within industries that barely existed a few decades ago. Apple has grown into the largest company in the world by making the iPhone, Electronic Artspublishes video games that consume countless hours of leisure time, and Facebook gives you a way to connect with friends new and old. These businesses all grew to be the giants they are by creating new demand and making their industries larger.

Friday’s Activity

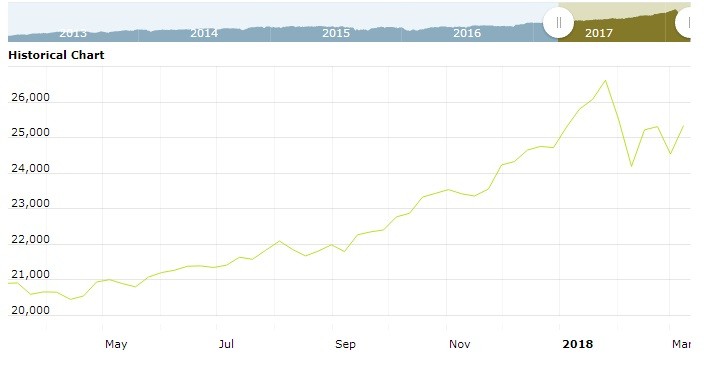

U.S. market were higher on Friday. For the day the Dow Jones Industrial Average closed at 25,335.74 for up with +1.77% percent or +440.53 point. The S&P 500 closed at 2,786.57 for up with +1.74% percent or +47.60 point. The Nasdaq Composite closed at 7,560.81 for up with +1.79% percent or +132.86 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,597.14 for up with 1.60% percent or +25.18 point; the S&P 600 Small-Cap Index closed at 970.26 for up with + 1.56% percent or +14.88 point; the S&P 400 Mid-Cap Index closed at 1,949.06 for up with +1.64% percent or + 31.43 point; the S&P 100 Index closed at 1,228.97 for up with +1.75% percent or +21.09 point; the Russell 3000 Index closed at 1,648.46 for up with +1.68% percent or +27.22 point; the Russell 1000 Index closed at 1,543.49 for up with +1.69% percent or +25.58 point; and the Dow Jones U.S. Select Dividend Index closed at 25,335.74 for up with +1.77% percent or +440.53 point.