U.S. stock futures higher in pre-market trading for Thursday, May 03. The Nasdaq Futures is trading at 6,644.50 up with +0.17% percent or +11.00 point.The S&P 500 Futures is trading at 2,632.50 up with +0.19% percent or +5.00 point.The Dow Futures is trading at 23,870.00 up with +45.00 percent or +45.00 point.

In overnight trading in the Eastern Hemisphere,Japan’s Nikkei 225 is trading at 22,472.78 with a loss of -0.16% percent or -35.25 point. Hong Kong’s Hang Seng is trading at 30,329.31 with a loss of -1.26% percent or -388.52 point. China’s Shanghai Composite is trading at 3,100.86 up with +0.64% percent or +19.68 point. India’s BSE Sensex is trading at 35,094.74 with a loss of -0.23% percent or -82.50 point at 12:15 PM.The FTSE 100 is trading at 7,541.62 with a loss of -0.012% percent or -0.93 point. Germany’s DAX is trading at 12,777.63 with a loss of -0.18% percent or -22.74 point. France’s CAC 40 is trading at 5,515.16 with a loss of -0.25% percent or -14.06 point. The Stoxx Europe 600 is trading at 386.47 with a loss of -0.25% percent or -0.95 point.

Thursday’s Factors and Events

Wednesday’s Activity

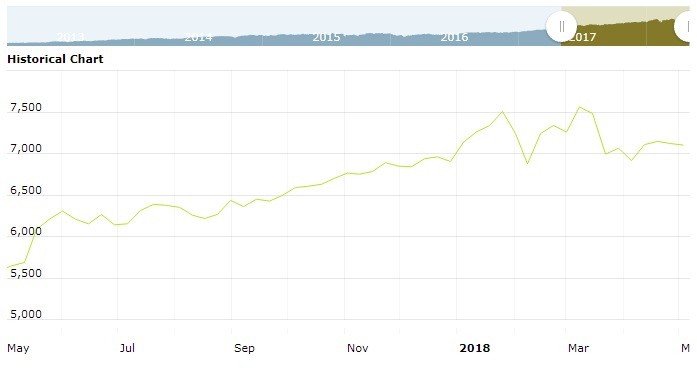

U.S. market were lower on Wednesday.For the day The Nasdaq Composite is trading at 7,100.90 with a loss of -0.42% percent or -29.81 point. the Dow is trading at 23,924.98 with a loss of -0.72% percent or -174.07 point. The S&P 500 is trading at 2,635.67 with a loss of -0.72% percent or -19.13 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,554.91 up with +0.29% percent or +4.57 point; the S&P 600 Small-Cap Index closed at 953.41 up with +0.16% percent or +1.53 point; the S&P 400 Mid-Cap Index closed at 1,875.83 with a loss of -0.20% percent or -3.74 point; the S&P 100 Index closed at 1,156.64 with a loss of -0.67% percent or -7.76 point; the Russell 3000 Index closed at 1,564.57 with a loss of -0.61% percent or -9.61 point; the Russell 1000 Index closed at 1,461.84 with a loss of -0.69% percent or -10.10 point;

The Federal Reserve held interest rates steady on Wednesday and expressed confidence that a recent rise in inflation to near the U.S. central bank’s target would be sustained, leaving it on track to raise borrowing costs in June.

The upgrading of the Fed’s inflation outlook represented a milestone after roughly six years of price gains falling short of its 2 percent goal, even as key aspects of the economy saw a healthy recovery from the 2007-2009 recession.

The Fed raised rates in March and currently forecasts another two increases this year, although an increasing number of policymakers see three as possible. Investors overwhelmingly expect a rate hike at the June 12-13 policy meeting.

After the release of the Fed’s statement, traders of U.S. short-term interest rate futures kept bets that rates would rise at least two more times in 2018. U.S. stocks pared losses before turning lower, Treasury yields briefly edged higher, and the dollar was off its highs of the day against a basket of currencies.