U.S. stock futures higher in pre-market trading for , March 29.The Nasdaq Futures is trading at 7,333.88 with a loss of -0.01% percent or -0.62 point.The Dow Futures is trading at 25,657.50 with a loss of -0.01% percent or -2.50 point.The S&P 500 Futures is trading at 2,809.62 with a loss of -0.03% percent or -0.88 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,033.76 with a loss of -1.61% percent or -344.97 point. Hong Kong’s Hang Seng is trading at 28,793.96 up with +0.23% percent or +65.71 point. China’s Shanghai Composite is trading at 2,992.80 with a loss of -0.99% percent or -29.92 point. India’s BSE Sensex is trading at 38,369.00 up with +0.62% percent or +236.12 point at 12:15 PM.The FTSE 100 is trading at 7,225.92 up with 0.44% percent or +31.73 point. Germany’s DAX is trading at 11,462.72 up with +0.38% percent or +43.68 point. France’s CAC 40 is trading at 5,306.45 up with +0.098% percent or +5.22 point. The Stoxx Europe 600 is trading at 377.92 up with +0.17% percent or +0.64 point.

Thursday’s Factors and Events

The U.S. Treasury yield curve has inverted before each recession in the past 50 years and has only offered a false signal just once in that time, according to data from Reuters.

A recent example is when the U.S. Treasury yield curve inverted in late 2005, 2006, and again in 2007 before U.S. equity markets collapsed. The curve also inverted in late 2018.

On the data front, the latest weekly jobless claims figures and a third reading of fourth-quarter GDP will be released at around 8:30 a.m. ET.

Pending home sales for February and Kansas City Fed survey data for March will follow later in the session.

Wednesday’s Activity

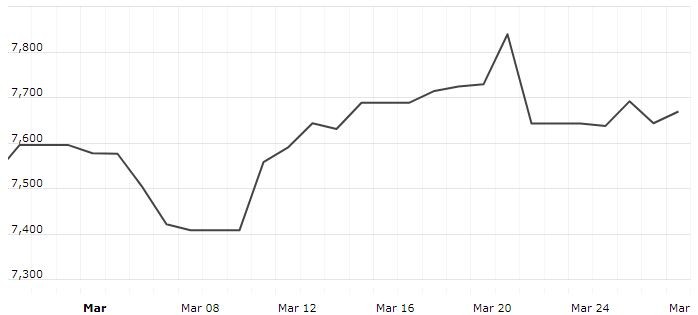

For the day The Nasdaq Composite is trading at 7,643.38 with a loss of -0.63% percent or -48.15 point. the Dow is trading at 25,625.59 with a loss of -0.13% percent or –32.14 point. The S&P 500 is trading at 2,805.37 with a loss of -0.46% percent or -13.09 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,522.23 with a loss of -0.39% percent or -5.93 point; the S&P 600 Small-Cap Index closed at 930.12 with a loss of -0.063% percent or -0.59 point; the S&P 400 Mid-Cap Index closed at 1,874.76 with a loss of -0.094% percent or -1.77 point; the S&P 100 Index closed at 1,240.05 with a loss of -0.50% percent or -6.17 point; the Russell 3000 Index closed at 1,652.96 with a loss of -0.46% percent or -7.64 point; the Russell 1000 Index closed at 1,553.64 with a loss of -0.47% or -7.27 point.