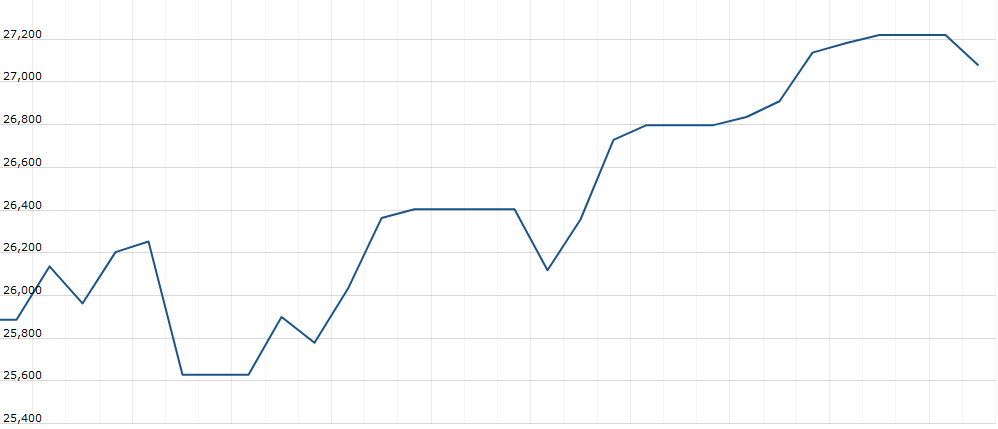

U.S. stock futures lower in pre-market trading for,September 18 The Nasdaq Futures is trading at 7,903.00 with a loss of -0.15% percent or -11.50 point.The Dow Futures is trading at 27,084.50 with a loss of -0.09% percent or -25.50 point. The S&P 500 Futures is trading at 3,004.38 with a loss of -0.12% percent or -3.62 point.

In overnight trading in the Eastern Hemisphere, In other parts of world, Japan’s Nikkei 225 is trading at 21,960.71 with a loss of – percent or –40.61 point. Hong Kong’s Hang Seng is trading at 26,776.10 with a loss of – percent or –14.14 point. China’s Shanghai Composite is trading at 2,985.66 up with + percent or +7.54 point. India’s BSE Sensex is trading at 36,617.98 up with + percent or +136.54 point at 12:15 PM.The FTSE 100 is trading at 7,330.04 with up + percent or +11.05 point. Germany’s DAX is trading at 12,389.01 up with +percent or +16.40 point. France’s CAC 40 is trading at 5,625.57 up with + percent or +10.06 point. The Stoxx Europe 600 is trading at 389.75 up with +0.11% percent or +0.39 point.

wednesday’s Factors and Events

The only technical events of import was the SPX (page 2) closing below its short term uptrend line turning said trend to neutral from positive while the VALU (page 5) closed above near term resistance.

The rest of the indexes are in near term uptrends as are the cumulative advance/decline lines for the All Exchange, NYSE and NASDAQ.

High “volume at price” (VAP) levels remain supportive.

However, we reiterate that the stochastic levels remain overbought, suggesting some potential for some market weakness. Moving form overbought to oversold is a regular phenomenon. The question is “When will the signals present themselves?”. As yet, they have not.

Tuesday Activity

For the day The Nasdaq Composite is trading at 8,186.02 up with + percent or +32.47 point.the Dow is trading at 27,110.80 up with + percent or +33.98 point. The S&P 500 is trading at 3,005.70 up with + percent or +7.74 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,578.29 with a loss of – percent or –6.31 point; the S&P 600 Small-Cap Index closed at 976.60 with a loss of – percent or –2.59 point; the S&P 400 Mid-Cap Index closed at 1,959.49 with a loss of percent or –6.60 point; the S&P 100 Index closed at 1,327.12 up with + percent or +2.82 point; the Russell 3000 Index closed at 1,764.50 up with + percent or +3.81 point; the Russell 1000 Index closed at 1,662.06 up with or +4.31 point.