U.S. stock lower in pre-market trading for,Feb 24.The Nasdaq Futures is trading at 9,154.62 with a loss of -3.21% percent or –303.38 point.The Dow Futures is trading at 28,152.50 with a loss of -2.86% percent or -828.50 point.The S&P 500 Futures is trading at 3,249.38 with a loss of -2.69% percent or –89.87 point.

In overnight trading in the Eastern Hemisphere,In other parts of world, Japan’s Nikkei 225 is trading at 23,386.74 with a loss of –0.39% percent or –92.41 point. Hong Kong’s Hang Seng is trading at 26,853.05 with a loss of –1.67% percent or –455.76 point. China’s Shanghai Composite is trading at 3,031.23 with a loss of –0.28%percent or-8.44 point. India’s BSE Sensex is trading at 40,783.77 with a loss of –0.94% percent or –386.35 point at 12:15 PM.Germany’s DAX is trading at 13,082.15 with a loss of –3.66% percent or –497.18 point. France’s CAC 40 is trading at 5,805.59 with a loss of –3.72% percent or –224.12 point. The Stoxx Europe 600 is trading at 3,142.20 with a loss of -1.22% percent or –38.83 point.

Monday’s Factors and Events

The reality of these two patterns setting up in the yield curve charts suggests that the U.S. and global markets are going to experience a surge in volatility and a very real potential that the U.S. and global markets will contract over the next 6 to 24 months. Within about 3 to 6+ months of these patterns setting up, one of two separate outcomes typically takes place.

A. A continued U.S. stock market price advance takes place pushing the yield curves lower and ultimately setting up a massive stock market top formation.

B. A moderate price peak sets up where the yield curve levels begin to rise from these current levels while the U.S. and global stock markets begin a moderate correction phase – eventually leading into the possibility of a massive price collapse.

Friday Activity

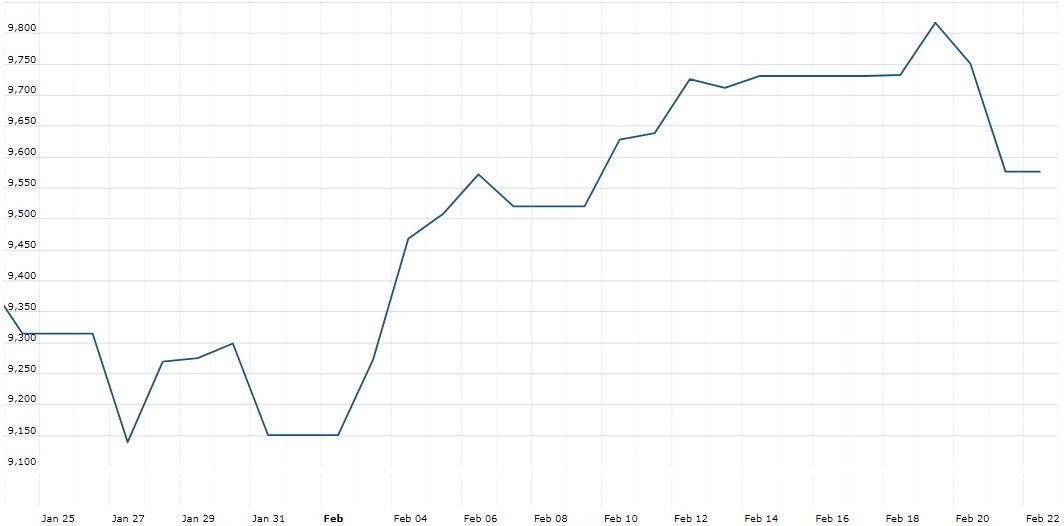

For the day The Nasdaq Composite is trading at 9,576.59 with a loss of –1.79% percent or –174.38 point.the Dow is trading at 28,992.41 with a loss of –0.78% percent or –227.57 point. The S&P 500 is trading at 3,337.75 with a loss of –1.05% percent or –35.48 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,678.61 with a loss of -1.03% percent or -17.46 point; the S&P 600 Small-Cap Index closed at 1,009.62 with a loss of –1.11% percent or –11.34 point; the S&P 400 Mid-Cap Index closed at 2,084.33 with –1.03% percent or ?21.79 point; the S&P 100 Index closed at 1,493.89 with a loss of –1.15% percent or –17.38 point; the Russell 3000 Index closed at 1,957.64 with a loss of –1.06% percent or –20.91 point; the Russell 1000 Index closed at 1,849.43 with a loss of –1.06% or –19.79 point.