U.S. stock futures are higher in pre-market trading for Thursday, March 29.The Nasdaq Futures are trading at 6,523.75 for up with +0.72% percent or +46.50 point.The S&P 500 Futures are trading at 2,616.75 for up with +0.35% percent or +9.25 point. The Dow Futures are trading at 23,928.00 for up with +0.28% percent or +66.00 point.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 are trading at 21,159.08 for up with +0.61% percent or +127.77 point. Hong Kong’s Hang Seng are trading at 30,093.38 for up with +0.24% percent or +70.85 point. China’s Shanghai Composite are trading at 3,160.53 for up with +1.22% percent or +38.24 point. India’s BSE Sensex are trading at 32,968.68 with a loss of -0.62% percent or -205.71 point at 12:15 PM.The FTSE 100 are trading at 7,073.23 for up with +0.40% percent or +28.49 point. Germany’s DAX are trading at 12,032.11 for up with +0.77% percent or +91.40 point. France’s CAC 40 are trading at 5,159.87 for up with +0.57% percent or +29.43 point. The Stoxx Europe 600 are trading at 370.82 for up with +0.44% percent or +1.63 point..

Thursday’s Factors and Events

The moves in pre-market trade come after markets on Wall Street closed in the red on Wednesday. Markets have been under pressure of late, as concerns surrounding global trade and data usage by social media firms dominate sentiment.

Wednesday’s Activity

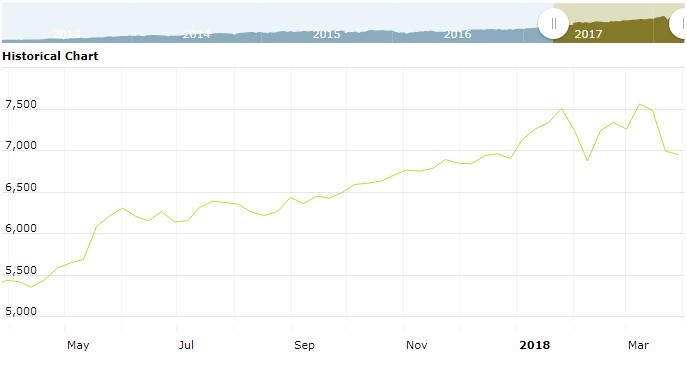

U.S. market were lower on Wednesday. For the day the Dow Jones Industrial Average closed at 23,848.42 with a loss of -0.04% percent or -9.29 point. The S&P 500 closed at 2,605.00 with a loss of -0.29% percent or -7.62 point. The Nasdaq Composite closed at 6,949.23 with a loss of -0.85% percent or -59.58 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,513.03 with a loss of -0.04% percent or -0.54 point; the S&P 600 Small-Cap Index closed at 929.30 for up with +0.16% percent or+1.44 point; the S&P 400 Mid-Cap Index closed at 1,853.78 for up with +0.11% percent or +2.03 point; the S&P 100 Index closed at 1,141.50 with a loss of -0.20% percent or -2.24 point; the Russell 3000 Index closed at 1,544.78 with a loss of -0.27% percent or -4.24 point; the Russell 1000 Index closed at 1,445.11 with a loss of -0.29% percent or -4.25 point; and the Dow Jones U.S. Select Dividend Index closed at 23,848.42 with a loss of -0.04% percent or -9.29 point.