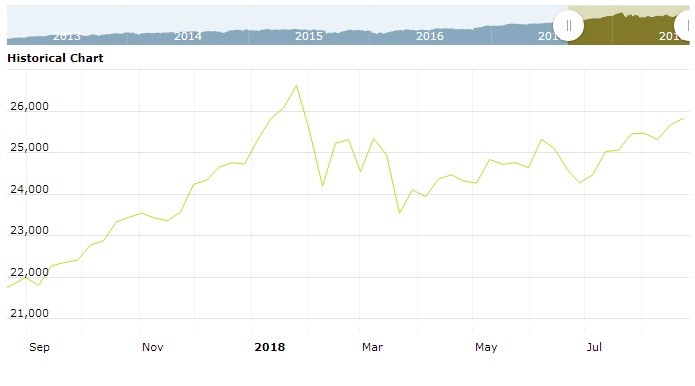

U.S. stock futures mixed in pre-market trading for Wednesday, August 22.The Nasdaq Futures is trading at 7,399.50 up with +0.09% percent or +6.50 point.The Dow Futures is trading at 25,796.00 with a loss of -0.04% percent or -11.00 point. The S&P 500 Futures is trading at 2,859.75 with a loss of -0.07% percent or -2.00 point.

In overnight trading in the Eastern Hemisphere, Japan’s Nikkei 225 is trading at 22,362.55 up with +0.64% percent or +142.82 point. Hong Kong’s Hang Seng is trading at 27,862.52 up with +0.40% percent or +109.73 point. China’s Shanghai Composite is trading at 2,713.36 with a loss of -0.75% percent or -20.46 point. India’s BSE Sensex is trading at 38,285.75 up with +0.018% percent or +7.00 point at 12:15 PM.The FTSE 100 is trading at 7,588.22 up with +0.30% percent or +22.52 point. Germany’s DAX is trading at 12,411.02 up with +0.21% percent or +26.53 point. France’s CAC 40 is trading at 5,429.56 up with +0.39% percent or +20.97 point. The Stoxx Europe 600 is trading at 384.87 up with +0.19% percent or +0.19% point.

Wednesday’s Factors and Events

A “bull market” is generally defined as one with at least twenty percent gains and no period when the market loses twenty percent or more.

What is not clear is who came up with that definition, or why twenty percent is the magic number. Still, it is generally accepted among traders and investors, so that definition works for the purpose of this discussion.

As you can imagine, if even the definition of the phrase can be regarded as controversial, there are other areas of disagreement associated with it. Before we even get to the “momentous” day, there are those, as detailed in this Bloomberg article, saying that the assertion that tomorrow will mark the longest bull run ever are simply inaccurate. They have a point.

Tuesday’s Activity

U.S. market were higher on Tuesday.For the day The Nasdaq Composite is trading at 7,859.17 up with +0.49% percent or +38.17 point. the Dow is trading at 25,822.29 up with +0.25% percent or +63.60 point. The S&P 500 is trading at 2,862.96 up with +0.21% percent or +5.91 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,718.05 up with +1.14% percent or +19.35 point; the S&P 600 Small-Cap Index closed at 1,089.41 up with +1.21% percent or + 12.99 point; the S&P 400 Mid-Cap Index closed at 2,034.67 up with +0.80% percent or +16.23 point; the S&P 100 Index closed at 1,266.54 up with +0.18% percent or +2.30 point; the Russell 3000 Index closed at 1,702.64 up with +0.33% percent or +5.57 point; the Russell 1000 Index closed at 1,588.74 up with +0.26% percent or +4.14 point;